How Bitcoin’s demand-supply dynamics and energy consumption will unfold as we approach the fourth halving

In the depths of a Bitcoin bear market, miners rank among the entities which are the most directly impacted. They have invested heavily in algorithm-specific mining hardware whose perspective payback and return is directly tied to the price of BTC. As a result of the bearish conditions, the prices of ASIC mining hardware has been dropping rapidly, some mining construction has been halted, and profit margins have been tightened.

On top of this, the next Bitcoin halving is rapidly approaching, an event which halves the regular block subsidy miners receive for appending blocks. In the absence of a price rise for BTC and with fees only representing roughly 1% of each block reward, this event virtually reduces the amount of income for miners by half.

However, deeper analysis of the dynamics surrounding Bitcoin gives reason to hold optimism. With the next halving estimated to take place in April 2024, we analyze how market dynamics and Bitcoin network developments may unfold in the lead up to and after this event.

Bitcoin demand-supply dynamics as halving approaches

Although it is impossible to accurately forecast the price of Bitcoin, demand-supply dynamics and shifts are one of the most important variables impacting how price evolves. Analysts have highlighted various reasons to be optimistic on the demand-side.

Starting with the demand, we can confidently say that the demand for an asset like Bitcoin is on the rise. Research from Blockware Solutions and analyst Willy Woo estimate that we are still in the early stages of Bitcoin adoption. A research report by Blockware Solutions foresees strong continued adoption over the coming years for Bitcon.

Bitcoin analyst Willy Woo has compared Bitcoin’s adoption to the internet’s S-Curve adoption. The internet had one of the most rapidly adopted technologies and Willy Woo has noted that to date, the early uptake of Bitcoin has outpaced the adoption in the early years of the internet. By comparison, Woo estimates that Bitcoin is currently where the internet was in 1997.

On the supply-side, the halving event will naturally reduce the amount of fresh BTC coming into the market, favoring upside price movements in the case of constant demand. In the current halving epoch, roughly 900 new BTC are minted by miners every day. A significant portion of these can be expected to find their way to the market to cover operational expenses.

With the halving incoming, less newly minted BTC will be finding its way to the market. Miners will still have the capacity to sell their Treasury-held BTC but with Bitcoin users continuously favoring long-term holding, demand-supply dynamics are shaping up to be favorable for long-term price outlook. The number of holders that have held BTC for at least 1 year has recently reached all-time highs and favors long-term growth in Bitcoin.

Although the upcoming halving will reduce the income for miners and may spur some selling pressure from them, deeper analysis highlights that many BTC holders are resolute in their long-term outlook. Such outlooks will transcend the halving event and will raise the odds of price growth leading up to the halving and beyond.

The halving and Bitcoin’s security budget

Adoption and favorable demand-supply dynamics are not the only factor to consider when it comes to Bitcoin’s halving event. Regardless of how price movements play out with the halving, it is important to consider that Bitcoin’s security model has continued to grow from strength to strength as increasing amounts of hardware continuously come online to underpin Bitcoin consensus.

According to Cambridge Center for Alternative Assets, Bitcoin currently uses approximately 17.23 GW of electricity. All of this comes from specialized mining hardware distributed around the world. Regardless of market conditions, this hardware has continued to come online in greater numbers. Even in the harshest of market conditions, the most efficient miners always seek to accumulate such hardware to help secure the BTC network.

This plays into what is referred to as Bitcoin’s security budget. The greater the amount of hardware operating on the Bitcoin network, the greater the cost is to attack the network. And miners continue to pump capital into increasing this cost. Pseudonymous analyst Level39 recently highlighted how the revenues earned by miners are predominantly used to purchase energy to secure the network while a small margin to pay for other operational expenses (OpEx) items.

Another analyst Jaran Mellerud has highlighted that Bitcoin has also become increasingly efficient in its energy usage. Due to the efficiency of mining hardware improving, Bitcoin has been able to produce an increasing amount of hashes which are used to secure the Bitcoin network per unit of energy consumed.

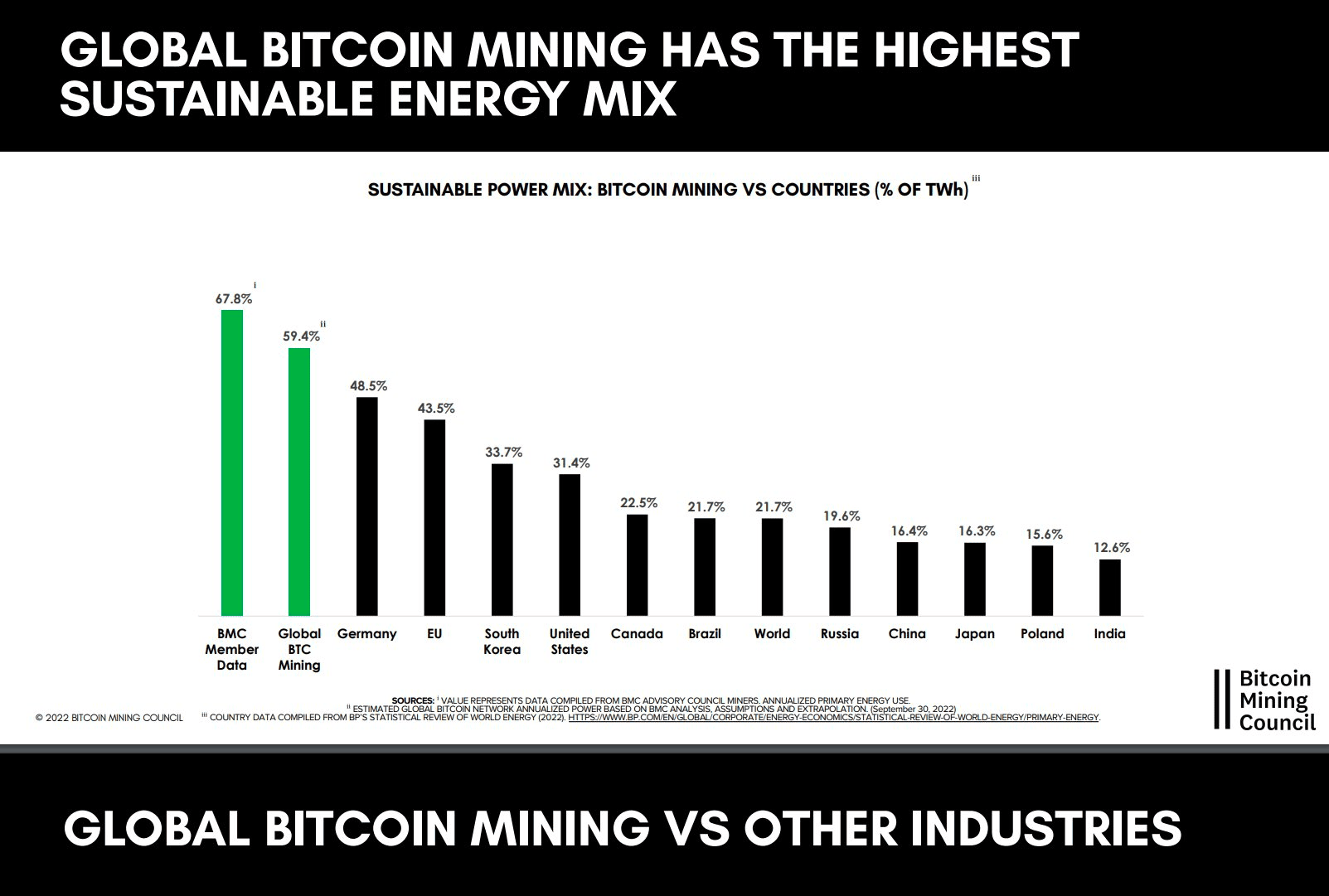

The energy is also coming increasingly from renewable sources. According to the Bitcoin Mining Council’s last quarterly report, it is estimated that the current Bitcoin Network is sourcing 59,4% of its energy from sustainable energy sources. This makes the mining industry one of the cleanest in the world, especially with the latest developments in methane emissions mitigation.

Source: Marathon Digital Mining and BMC

Bitcoin’s Fourth Halving – Fear or Fuel?

In a historical context, Bitcoin’s halving events have always inspired a high degree of fear. Critics tout an unsustainable security model with miner liquidations widely anticipated in response to the reduced revenue miners can naturally expect.

However, in reality, the fears surrounding Bitcoin’s halving events have never materialized in reality. One of Bitcoin’s core innovations is the difficulty adjustment. Even in the event of a significant percentage of miners becoming unprofitable, Bitcoin’s difficulty will afterwards adjust downward, making mining a more lucrative activity across the industry.

When this is taken into consideration alongside Bitcoin’s favorable demand-supply dynamics and its constantly rising security budget, it appears that Bitcoin’s halving may act more as a fuel for success than a reason for fear. The halving is an indispensable element of Bitcoin’s innovative supply issuance schedule.

There has always been widespread speculation over its potentially harming impact on Bitcoin prospects. However, to date, it has only served as a part of a wider progression where Bitcoin grows from strength to strength.