Trump commits to utilizing Bitcoin as a key strategic asset likely catalyzing other nation-states to follow suit

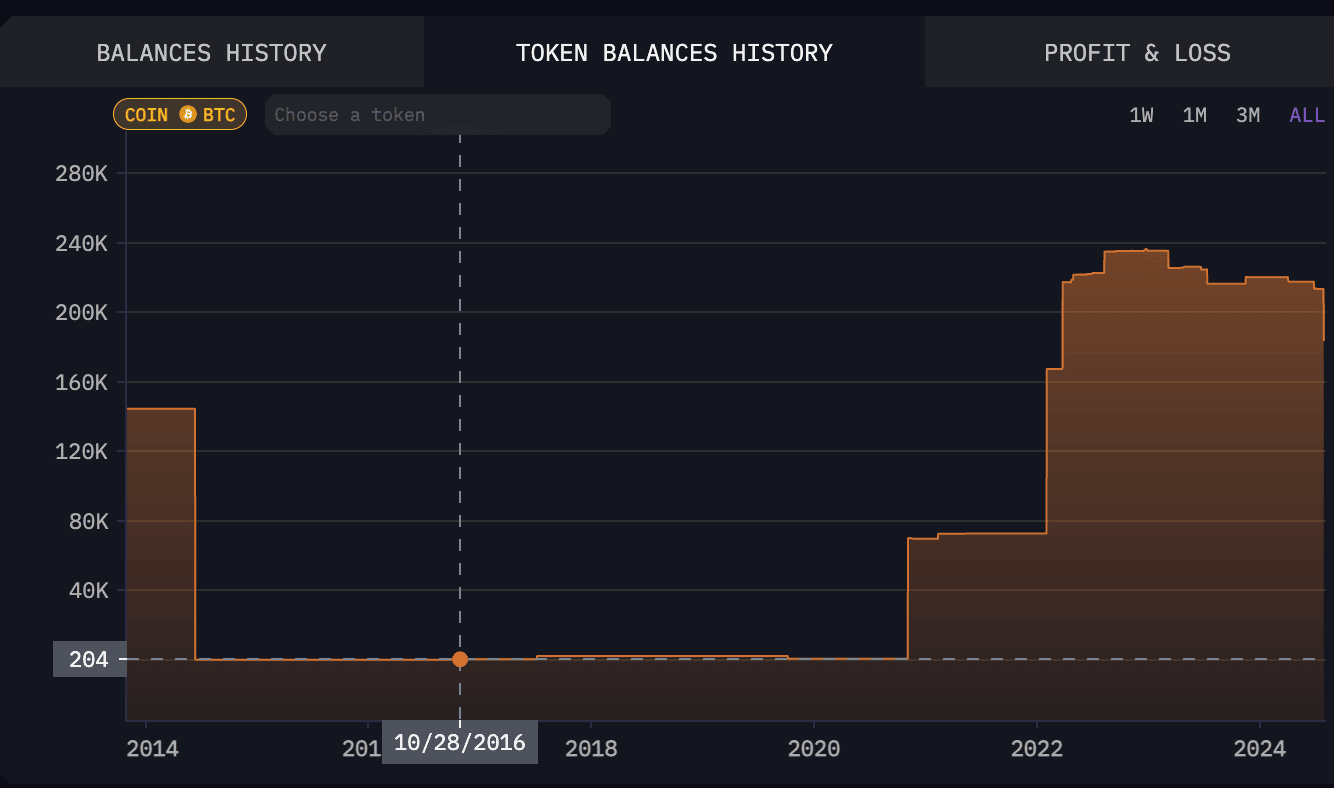

Presidential candidate Donald Trump delivered a keynote at last week’s Nashville Bitcoin conference where he made a commitment to building a ‘strategic bitcoin reserve’ for the US government should he be elected in November. With the US government already controlling over 200,000 BTC, this announcement sent shockwaves through the industry and was the wrap-up to an extremely positive 50-minute keynote for both Bitcoin and Bitcoin mining.

Following Trump’s keynote, a Hong Kong politician noted that he would begin discussing the feasibility of including Bitcoin in the financial reserves of the Hong Kong government. With El Salvador holding bitcoin as a reserve asset since 2021, these recent announcements resurface the possibility of nation-states scrambling to adopt BTC as legal tender and utilize it as a reserve asset within their Treasury.

With Trump currently heavily favored to win the election, bitcoin will likely be used as a reserve currency by the biggest economic power in the world by the end of the year and we will likely see a series of positive developments for US Bitcoin miners should he be elected. Such a scenario holds the possibility to reverberate quickly across the world and gives rise to both interesting game theory scenarios and extremely positive price implications.

The Game Theory of Nation-States Utilizing Bitcoin as Strategic Reserves

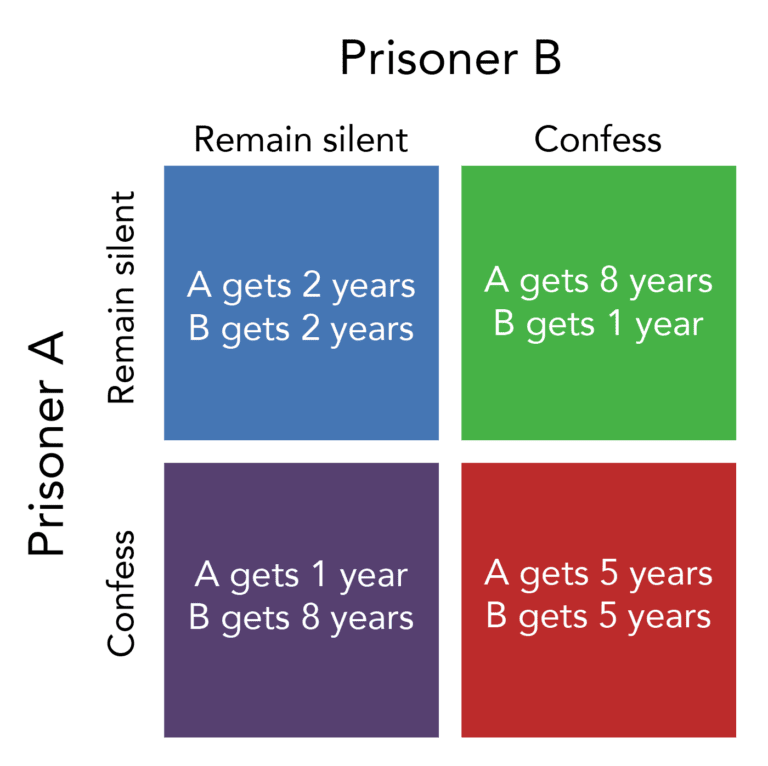

In the classic Prisoner's Dilemma used in economic classes worldwide to describe game theory, a scenario is presented where two prisoners are suspected of committing a crime together and are detained separately. As the evidence is weak, they are both offered the same deal but they cannot communicate regarding the deal.

If they both remain silent, they will get two years in prison each. If one of them confesses and the other does not, the one that does not confess gets eight years while the other gets one year. If they both confess, they will get eight years.

In this scenario, the incentives are aligned to push the prisoners to confess. The Prisoner’s Dilemma highlights how entities acting in their self-interest with no collaboration can produce non-optimal outcomes.

(Source: lumenlearning.com)

Game theory is commonly applied to industries and market dynamics where it can give rise to strong incentives. For instance, in the case of oil oligopolies, if the major producers restrict output, they can ensure high oil prices and profits. However, each producer runs the risk that another may flood the market with supply and crash prices, creating an incentive for them to also ensure they are distributing significant supply onto the market.

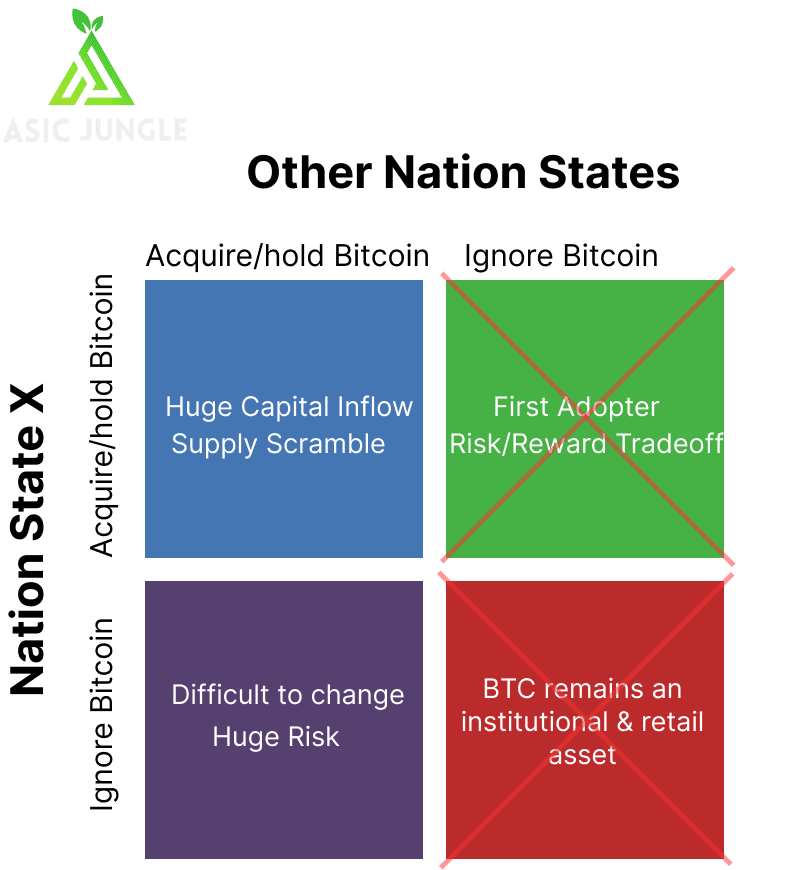

When game theory is applied to the case of nation-states and bitcoin, there will be a strong incentive to acquire bitcoin should the United States adopt it as a reserve asset. We can analyze the perspective of a single nation-state considering the decision to make in the context of what all other nation-states may do.

The option of any nation is to either acquire and hold Bitcoin, utilizing it as a reserve asset, or to continue to ignore it. For a long time, all nation-states generally considered Bitcoin to be somewhat of a threat and they collectively ignored it, representing the lower right square in the below graphic.

However, this changed when El Salvador adopted Bitcoin as a reserve asset, becoming the first nation-state to do so. Being the first to do so entails a risk/reward tradeoff. If the country undergoes financial troubles and is forced to sell at a loss, the leaders who pushed for the move would be ridiculed by their peers. In the case of El Salvador, it has gone the opposite way and they are viewed by many as a leader for their decision to adopt Bitcoin. This is represented by the upper right square in the below graphic. These options are now unavailable given that El Salvador has already adopted Bitcoin as a reserve asset.

However, El Salvador is a small country with insignificant global clout. Their move to adopt Bitcoin did not generate a huge urge for other countries to follow suit. The case would be entirely different should the United States adopt Bitcoin as a reserve.

In this case, countries are left with the options to either also begin acquiring Bitcoin and hold it as a strategic asset or to continue to ignore, an option which becomes extremely risky. Should a nation-state choose to continue ignoring Bitcoin, they risk never being able to acquire the asset at reasonable prices. Other nation-states will likely follow in the footsteps of the United States in making BTC a reserve asset and this would likely spur significant price appreciation, making it difficult for a nation-state to reverse their decision to ignore the asset. In the long-term, they may risk being seen as a country which is antiquated and unwilling to embrace technology.

United States Bitcoin Reserve Adoption to Catalyze Supply Scramble and Widen Mining Margins

Should they choose to join in and acquire Bitcoin, this will create interesting market dynamics. It could create a huge scramble to acquire significant amounts of the remaining supply. The United States already controls over 200,000 Bitcoin, representing roughly 1% of the total supply.

United States Government Bitcoin Balance (Source: arkhamintelligence.com)

With the Bitcoin supply capped at 21 million, nation-states moving to acquire significant BTC amounts for their reserves could foster extremely bullish demand-supply dynamics. Nation-states commanding significant financial capital could be competing with one another to obtain a significant share of Bitcoin supply, a phenomenon which would naturally act as a huge driver to price. This would naturally be a huge boost for Bitcoin ASIC miners worldwide as price increases would widen margins until difficulty could catch up.

In the aftermath of the Trump keynote, Bitcoin climbed to a key level of $70k. It has since retraced closer to $66k but the strong prospect of Bitcoin becoming a reserve asset for the biggest nation-state has set the tone for an extremely bullish remainder of the year. The 2017 bull market was almost exclusively driven by retail participants. In 2021, we saw institutions enter the market and bring it to new heights. Nations-states may be the catalyst which brings BTC to new boundaries in this market cycle.