Huge potential upside for Bitcoin and miners if current market turbulence exacerbates

Trillions have been wiped from global equity markets as a rate hike in Japan and a stronger Yen sparked turmoil. For the past three years, hedge funds and major investors have been capitalizing on Japan’s low interest rates by borrowing funds in Yen and investing in markets with higher returns, known as a carry trade.

However, the sudden rate hike has forced these investors to rapidly unwind their positions, catalyzing the biggest drop in equity prices since the COVID-19 outbreak. The S&P 500 dropped roughly 10% from its recent all-time high with other major markets also recording significant losses.

The Bank of Japan has since released statements that it will refrain from further rate hikes while the markets are in turmoil but the drops continue as weak earnings and geopolitical fears surface. With the prospect of a global recession looming, how Bitcoin and miners will fare in these conditions is a pertinent topic.

Bitcoin Demand-Supply Dynamics Strong Despite Turbulent Economic Backdrop

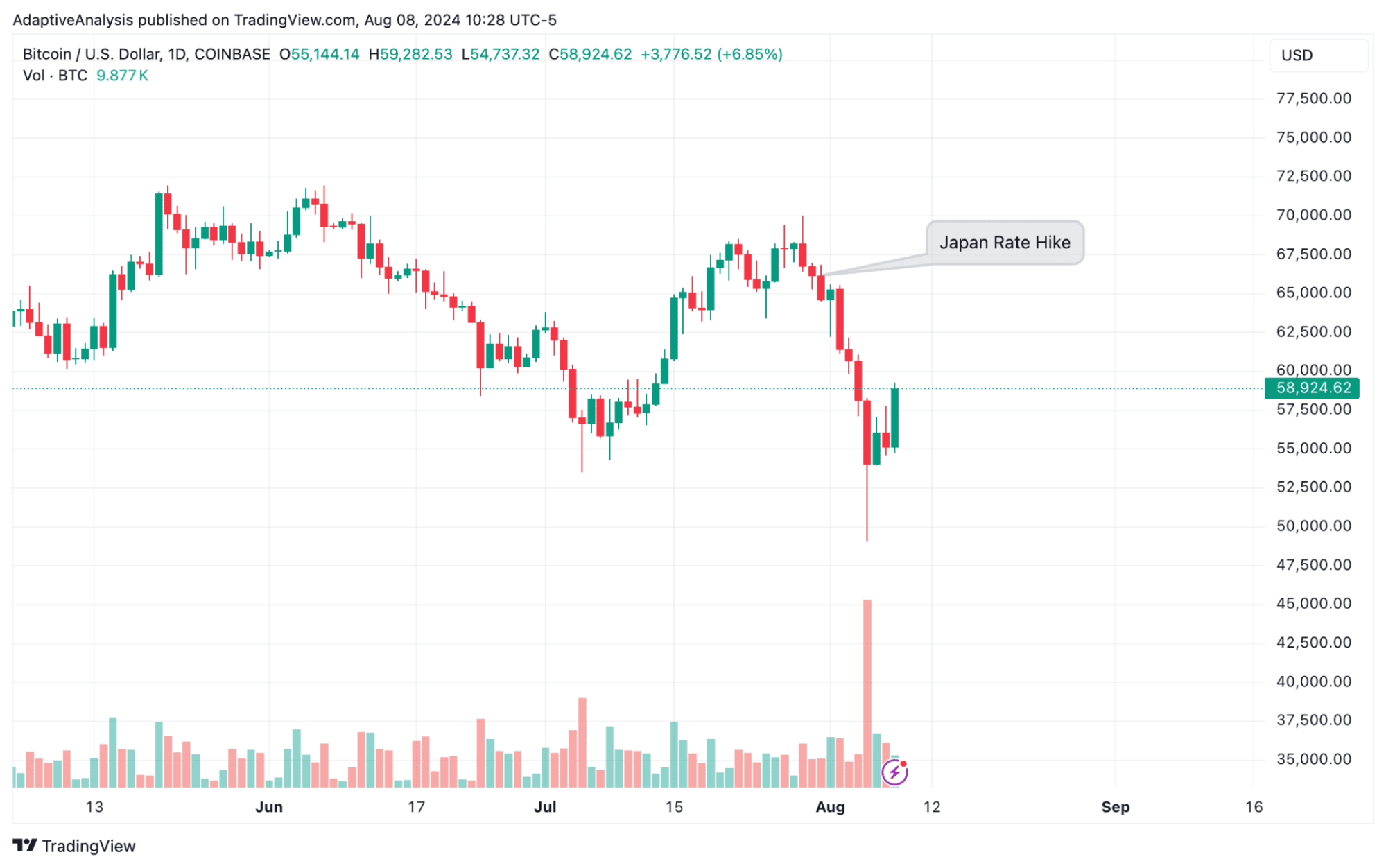

Bitcoin was not immune to the immediate fear which spread throughout the global markets. The unexpected rate hike by the Bank of Japan catalyzed a drop which brought BTC briefly below $50,000 from trading at $66,000 beforehand. It has since rebounded strongly to current trading at $59,000 despite major equity indices struggling.

(Source: Tradingview.com)

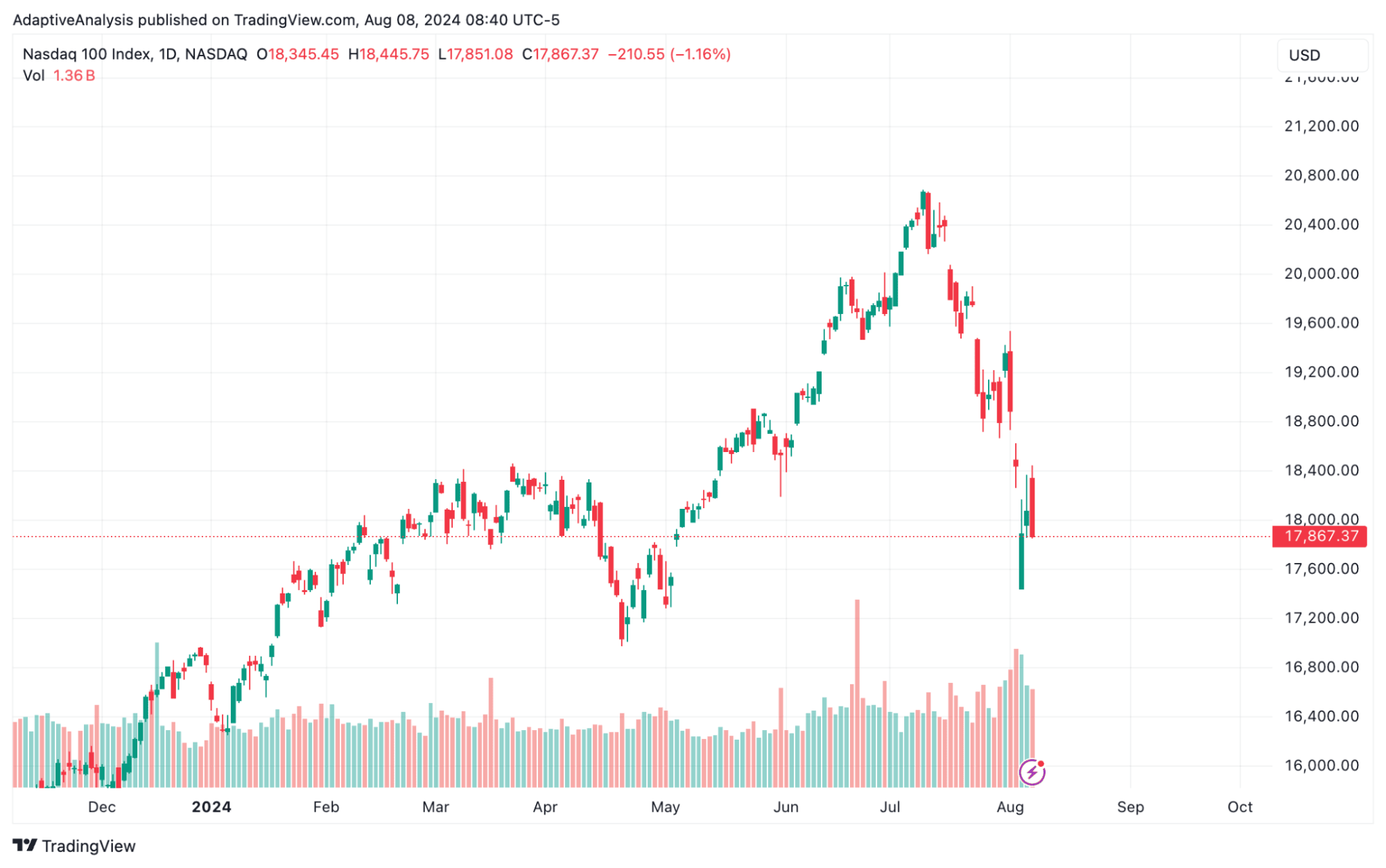

The S&P 500 dropped 10% from its recent all-time highs while the tech-heavy NASDAQ retraced almost 16% from its highs. Bitcoin frequently holds a positive correlation with equities as investors typically treat both as risk-on assets. However, as a looming economic crisis unfolds, the foundations may be in place for BTC to outperform. Whether Bitcoin will act as a risk-on asset or safe haven during prolonged economic turbulence has been a longstanding point of contention. Here are the reasons to be optimistic.

(Source: Tradingview.com)

As previously discussed, nation-states may be on the verge of adopting BTC as a strategic asset within their Treasury reserves. With a strong possibility of Trump being elected later this year, the former President has committed to holding the 1% of Bitcoin supply which the US government currently holds along with any future BTC the government acquires.

Such a development would likely force other governments to at least consider utilizing Bitcoin within their Treasury reserves, sparking a wave of nation-state adoption. Even in the case of a global economic downturn, an inflow of even a small percentage of the capital controlled by nation-states worldwide would have a huge upside impact on the $1.14 trillion Bitcoin market cap.

The US government is not the only entity which will keep a hold of their BTC. Outside of governments, 9.34% of the total 21 million BTC is held by a mixture of public and private companies, funds, and DeFi platforms. With each of these having their Bitcoin as part of a long-term strategy, the supply actively available on the market is further tightened.

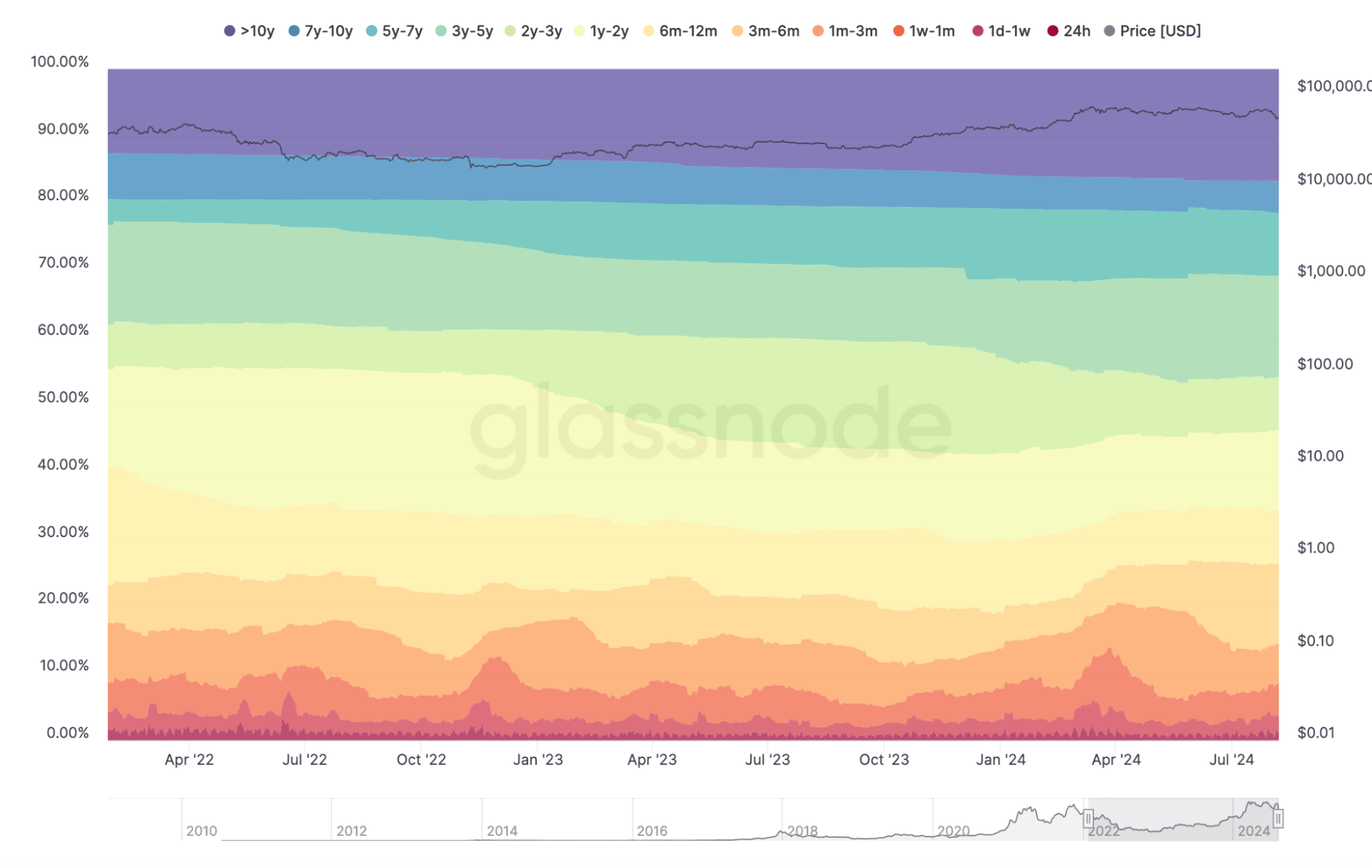

An on-chain analysis of UTXOs also highlights that an increasing share of the overall supply has been unmoved for long periods. As of August 7th, 30.79% of the BTC supply has been unmoved in over 5 years, compared with 24.21% two years ago. This shows an increasing share of BTC holders keeping their supply unmoved for long timeframes, constricting the supply readily available on the market and acting as an upward pressure on price in times of high demand.

(Source: unchained.com)

The combination of Bitcoin rebounding strongly despite the recent market turmoil and demand-supply dynamics shaping up extremely positively suggests that BTC may be strongly positioned if current conditions continue to exacerbate. If BTC outperforms during a phase of harsh market conditions, investors may increasingly view it as a safe haven asset, attracting further capital to the market. This could give rise to a cyclical effect whereby BTC outperforming attracts capital to the market which results in price appreciation that in turn further reinforces the perception of BTC as a safe haven asset.

Bitcoin Miners Strongly Positioned in the Case of a Global Recession

If Bitcoin is well positioned for a potential global recession, miners are in an even better position. At current prices and difficulty, Bitcoin miners with latest-gen equipment are operating at wide profit margins. For instance, the latest-generation S21 machine with a hashrate of 200 TH/s would have a breakeven electricity price of $0.096 per kWh assuming no costs outside of electricity.

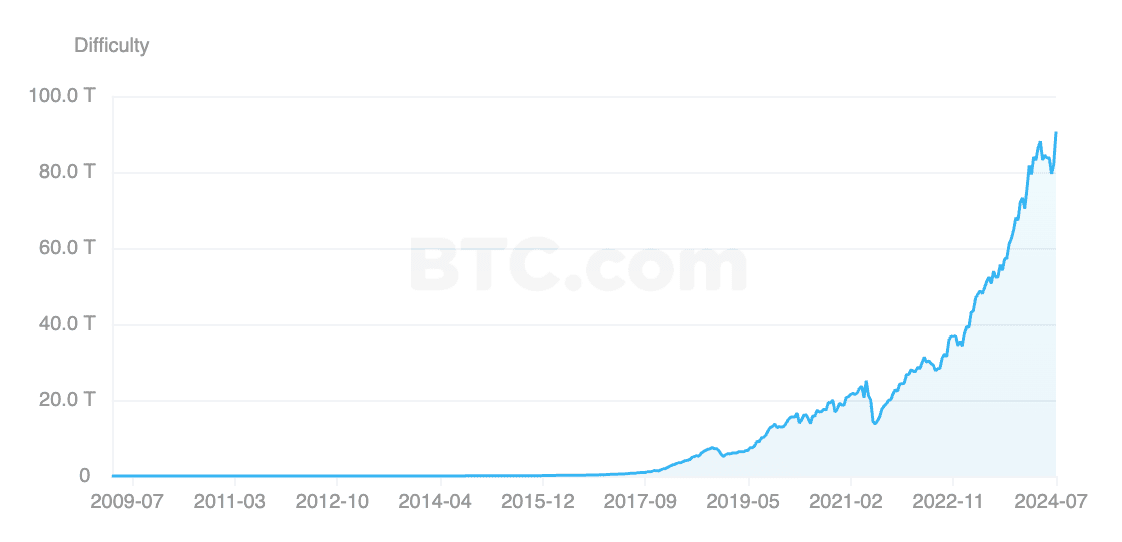

With the majority of professional miners securing electricity rates of $0.05 per kWh and below, most miners are well positioned to operate profitably even if a harsh recession hits and BTC prices plummet. The lucrative mining conditions are highlighted by the recent difficulty jump of 10.5% which was the largest change since an increase of 13.55% in October of 2022 after a new generation of ASIC hardware proliferated.

Even in light of the difficulty jump, Bitcoin miners are still extremely profitable, especially private industrial miners that have setups with sub-$0.03 per kWh electricity. Publicly-listed mining companies may be among those that struggle if a recession hits as they may see their stock prices impacted and they will also need to meet the expenses associated with running a public company and meeting executive salaries.

However, Bitcoin mining overall is in an extremely healthy position. Even at the current difficulty highs, Bitcoin could drop as low as $18,000 before a miner with $0.03 electricity becomes unprofitable. In the case of such drops actually occurring, the price would be even lower in reality as significant difficulty drops would follow as miners above $0.03 would be forced to turn their equipment off.

(Source: BTC.com)

This is considering that BTC prices drop if a global recession hits. As described in the previous section, there is a strong possibility that the opposite could occur. In this case, miners would doubly benefit from wider profit margins and a decrease in new competition as there would be fewer new entrants to mining in the case of a global recession.